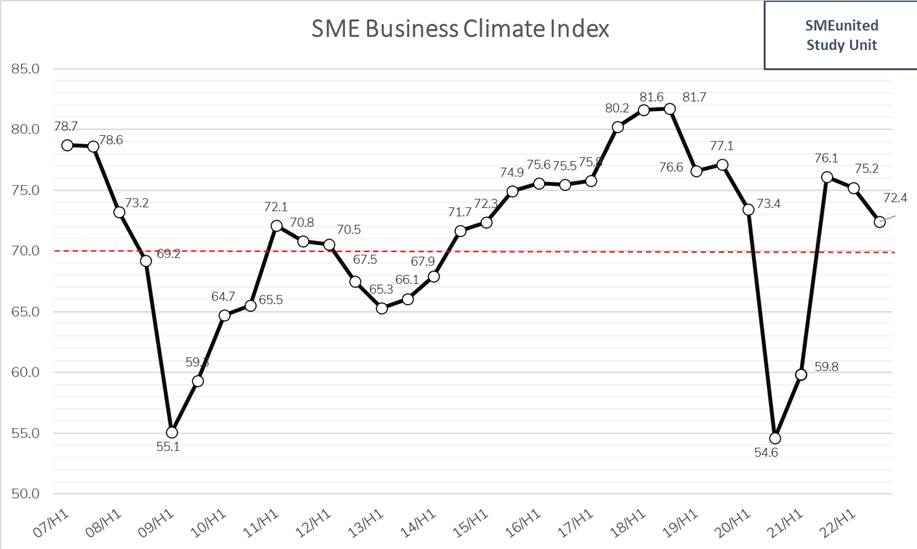

The downward trend of the Business Climate Index, which started at the beginning of 2022 is continuing, but decelerating. This displays a slowdown of the post covid recovery, the cause of which can be attributed to high energy prices and trade restrictions following the war in Ukraine. These factors lead to an increase in core inflation, which in turn also contributed to the slowdown. Furthermore, supply chain disruptions and labour shortages also play a role in this slowdown.

In Autumn 2022, the performance of SMEs declined. The orders and turnover both decreased due to the reduced purchasing power of households. However, SMEs reported that they were able to increase their prices in order to minimise their losses. A slight increase in the figures concerning investments gives evidence that SMEs might have invested in energy-saving measures in order to avoid further costs on that side.

The results for Autumn 2022 are significantly above the original expectations, showing that the concerns towards a possible degradation of the economic context did not evolve as far as expected. However, the results regarding employment are lower than expectations, revealing the depth of the labour shortage issue.

In Spring 2023, prices are expected to continue increasing. This shows the ability of SMEs to pass on higher costs to consumers, resulting in an increase in core inflation that will carry on throughout the semester. However, there are some differences between sectors. The manufacturing sector benefits from price decrease for commodities and energy, which reduces the price dynamic. On the other side, the labour intensive personal services sector is confronted with significant wage increases, which motivates SMEs in this sector to raise their prices. As for employment, the figures show some sort of stagnation at low levels, which emphasises the view of SMEs that labour shortages have become a persistent issue.

SME Barometer - Spring 2023

The SME Business Climate Index and EU Craft and SME Barometer

The SME Business Climate Index and EU Craft and SME Barometer

The SME Business Climate Index shows that the SMEs recovery came to an end with recession risk on the horizon. Even if the results for the last semester are significantly above expectations, the BCI reports a 2.8% decline in SMEs’ confidence for the future.

The SME Business Climate Index and EU Craft and SME Barometer

SMEs’ confidence shows recovery is on hold.

The latest SME Business Climate Index for the European Union reports a standstill of SMEs’

confidence for Spring 2022. Since last autumn, the percentage of SMEs expecting a positive or

neutral economic environment decreased by 0.9%, while the indicator at the second semester

of 2021 stood at 76.1%.